This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

News Category: Program Announcements

ACR Carbon Markets 101: High GWP Pollutants

By: Megesh Tiwari, Senior Technical Manager, American Carbon Registry

ACR’s Carbon Market 101 blog series explores and explains carbon markets and how ACR tackles various issues in our ongoing mission to set the bar for carbon credit quality.

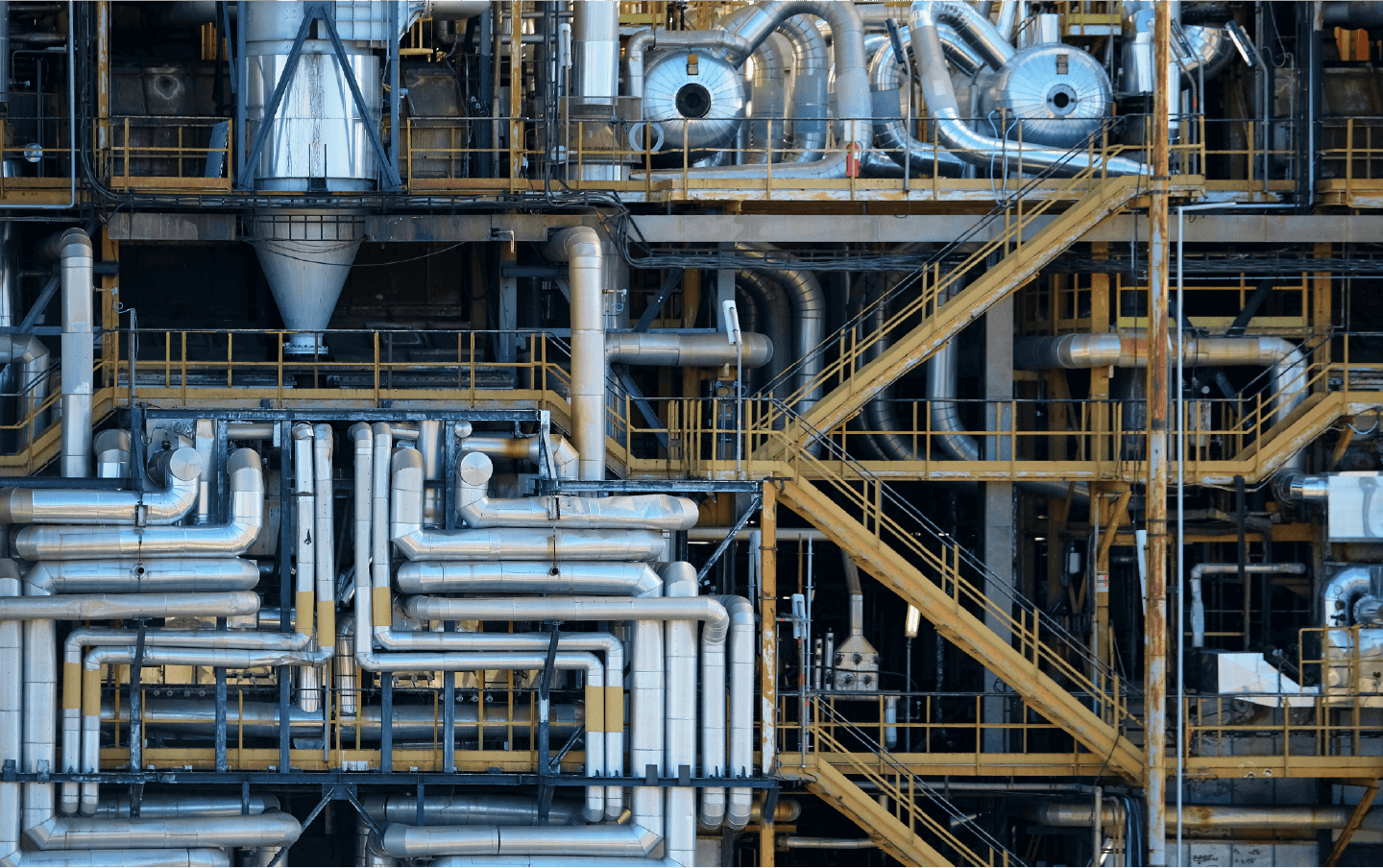

At ACR, we have a strong focus on incentivizing actions to reduce and eliminate extremely potent non-CO2 climate pollutants like methane, hydrofluorocarbons (HFCs), and ozone depleting substances (ODS) like chlorofluorocarbons (CFC) and hydrochlorofluorocarbons (HCFC). Given the potential to deliver significant climate impact, we thought it would be useful to introduce some of the central concepts associated with our innovative and industry-leading methodologies for refrigerants, foam blowing agents, ozone depleting substances, landfill emissions, and orphaned and abandoned wells.

What is Global Warming Potential?

To better understand the impact that different greenhouse gasses (GHG) have gasses have in contributing to the rise in the Earth’s temperatures, scientists established the concept of Global Warming Potential (GWP).

The GWP compares the emissions of one metric ton of different GHGs against the emissions of one metric ton of carbon dioxide (CO2) over a given period of time, most commonly over 100 years. GWP is a relative term and is calculated by dividing absolute GWP of a GHG by absolute GWP of CO2. As such, CO2 is the reference GHG with GWP value of 1. The higher the GWP value, the more it contributes to global warming. For instance, if a pollutant has a 100-year GWP value of five, it contributes to global warming at a rate of five times higher than CO2 over the period of hundred years from the date the pollutant was released into the atmosphere.

What are short-lived climate pollutants (SLCP)?

Another important distinction in comparing harmful pollutants is distinguishing short-lived GHGs from long-lived GHGs. For instance, CO2 can last for centuries in the atmosphere before breaking down, while methane, which has a high GWP, remains in the atmosphere for a much shorter period – only around a decade.

It takes 100 years for around 60-70% of the carbon dioxide to decay in the atmosphere. The rate of decay decreases over time, taking around 500 years for the additional 10% CO2 to decay and over thousands of years for all CO2 to decay. However, in the case of short-lived climate pollutants, like methane, HFCs and HCFCs, over half of the decay happens within first 20 years. In other words, these short-lived GHGs heat the atmosphere at a much higher rate in the initial years after their release, several times higher than their 100-year GWP values. For example, even though HCFC-22 (the most commonly used refrigerant in refrigeration and air conditioning) traps heat around 2,000 times more than CO2 over 100 years; but in the first 20 years, it traps heat around 5,000 times more than CO2. Because of these alarmingly high heat trapping properties, reducing emissions from these short-lived pollutants is critical for avoiding rapid warming of the planet in the short term.

Where are high GWP pollutants used?

High GWP pollutants are present in hundreds of manufacturing, industrial and agricultural processes. High GWP pollutants are often paid less attention than CO2 emissions, but they make a significant contribution in the rise of global temperatures. Global phaseout of HFCs can alone prevent 0.5C warming of the planet by 2100.

Methane, which has a GWP of between 27 and 30 over a 100-year period, is often found in agricultural production (which accounts for 23 percent of U.S. methane emissions), landfills (17 percent), and oil and natural gas operations (30 percent).

HFCs and perfluorocarbons (PFCs) – which can have GWP in the thousands – are used in a wide variety of applications, including air conditioning units, refrigerators and foam insulation.

HCFCs, which are also ODSs, were the most widely used compounds for refrigeration, air-conditioning and foam insulation before they were started to be phased out in 2020 in the US. However, many other countries have not yet begun to completely phase out use of HCFCs. And even in countries where HCFCs are being phased out, the market for recycled and reclaimed HCFCs in still huge, especially to service existing equipment. On top of this, even as old equipment gets replaced with new equipment that uses lower GWP alternatives, the remaining gas sits in stockpiles and eventually vents into the atmosphere.

What can be done to limit the use of high GWP pollutants?

Some groups of pollutants have been targeted by governments and international bodies and are strongly regulated or banned. For instance, the Montreal Protocol, which was ratified by all 198 United Nations Member States, calls for the phasing out of ODS, which are also high-GWP climate pollutants, through target dates and strong reporting measures.

But other high GWP GHGs like HFCs and methane are still present in hundreds of manufacturing, industrial and agricultural processes And while production and consumption of virgin HCFCs are banned in the US, the market for reclaimed HCFCs to service old (leaky) existing equipment is still robust.

Carbon markets can incentivize projects that remove or avoid the release of GHG emissions into the atmosphere. Revenue generated from carbon credits allows for the collection and safe destruction of these harmful pollutants, along with financing the transition to alternatives that contribute less to global warming.

For example, in the case of refrigerants, air conditioners and foam insulation, there are often low-GWP alternatives that already exist. Unfortunately, many of these alternatives are cost prohibitive and have not been widely adopted in the marketplace. Carbon markets can play a role in supporting industries to transition more quickly to low GWP alternatives.

The destruction of, and transition away from, these high GWP GHGs is irreversible, permanent and fully additional and has significant short-term impact on preventing global temperature rise. It is expected that as more companies continue to signal interest in purchasing these kind of carbon credits, the price of the credits will rise, creating more revenue for projects and catalyzing wider adoption of alternatives.

Examples of ACR methodologies focused on high-GWP, short-lived climate pollutants

Advanced Refrigeration Systems, version 2.1

Certified Reclaimed HFC Refrigerants, Propellants, and Fire Suppressants, version 2.0

Destruction of Ozone Depleting Substances and High-GWP Foam, version 1.2

Destruction of Ozone Depleting Substances from International Sources, version 1.0

Transition to Advanced Formulation Blowing Agents in Foam Manufacturing and Use, version 3.0

Capturing and Destroying Methane from Coal and Trona Mines in North America, version 1.1

Landfill Gas Destruction and Beneficial Use Projects, version 2.0

Plugging Abandoned & Orphaned Oil and Gas Wells, version 1.0 (in scientific peer review)

ACR Announces Public Comment Period for New Methodology for Avoided Conversion of U.S. Forests

Today, the American Carbon Registry (ACR) announces the launch of the public stakeholder consultation process for a new Methodology for the Quantification, Monitoring, Reporting, and Verification of Greenhouse Gas Emission Reductions and Removals from Avoided Conversion of U.S. Forests to Alternative Land Uses. The methodology was co-authored by Green Assets and ACR.

The methodology details eligibility and carbon quantification requirements for projects that forego conversion of non-federal U.S. forestlands to alternative land uses, including agriculture, mining, or development. The emission reductions are verified against a baseline of carbon stock changes that would result from conversion of the project area to the appraised highest and best use of the land, which represents the use that produces the highest value for the property. Additionality is assured by a legal commitment to retain the project area as forestland, such as a conservation easement specific to the carbon project.

“Each year, hundreds of thousands of acres of forests in the U.S. are converted to other land uses,” said Green Assets CEO Bailey Evans. “Carbon finance is a critical mechanism in mitigating forest loss and helping to combat climate change. Landowners face ever-changing scenarios for managing and maintaining their land, and this methodology will promote forest conservation and stewardship through an innovative mechanism for quantifying and incentivizing the benefits of forest conservation.”

Following the period of stakeholder consultation, the next phase of the methodology approval process is scientific peer review. ACR hopes to finalize the process and publish the methodology in the first quarter of 2023.

“Green Assets has been a leader in the development of the majority of California Air Resources Board’s (ARB) avoided conversion forest carbon projects in the country,” said Mary Grady, ACR Executive Director. “They have brought their extensive experience of avoided conversion projects within the regulated market to the development of this new methodology, which builds on the existing compliance protocol while broadening market access to a wider range of landowners through aggregation, as well as enhancing impact by accounting for the effects of land conversion on soil carbon loss.”

Public comments may be submitted to ACR@Winrock.org by November 7, 2022, with the subject line “AC Methodology Version 1.0 Public Comments”.

ACR Announces Stakeholder Consultation for CCS Methodology v2.0

The American Carbon Registry (ACR), a nonprofit enterprise of Winrock International, has published for stakeholder consultation an updated version 2.0 of its Methodology for the Quantification, Monitoring, Reporting and Verification of Greenhouse Gas Emissions Reductions and Removals from Carbon Capture and Storage Projects.

As in the current published version of the methodology, greenhouse gas emission reductions and removals are quantified from the capture, transportation, and storage of anthropogenic CO2. The new version of the methodology extends eligibility to projects that utilize Carbon Dioxide Removal (CDR) technologies such as Direct Air Capture (DAC) and the use of Sustainable Biomass as a feedstock. The methodology also expands the eligibility criteria for geologic storage to include saline formations and depleted oil and gas reservoirs which will significantly expand the geographic range for supported projects. For projects that utilize CO2 for Enhanced Oil Recovery, Version 2.0 includes calculations to account for emissions from transportation, refining, and end use of the produced hydrocarbons.

Please send comments to ACR@Winrock.org with the subject line “CCS Methodology Version 2.0 Public Comments” by November 1, 2022.

ACR Provides Comments to ICVCM

September 27, 2022 – Today ACR submitted formal comments to the Integrity Council for Voluntary Carbon Markets (ICVCM) on the Core Carbon Principles and draft Assessment Framework for ensuring carbon credit quality.

We recognize and appreciate the significant work that has gone into the development of the framework as well as the meaningful work ahead of us to provide constructive input to the process.

We appreciate the opportunity to provide our feedback and thoughts on a pathway forward in coordination with the ICVCM Board, Secretariat and Expert Panel.

We firmly believe in the importance of ensuring the integrity of crediting systems and resulting emission reductions and removals credits in global carbon markets, and know how important this is for building confidence and scaling the market to contribute to Paris Agreement goals.

We trust that the Board will carefully consider and reflect all input received when making decisions on the pathway to achieve the objectives of the ICVCM and remain committed to dedicating time and effort to this important shared exercise.

Read the comments here: ACR Comments to ICVCM

ACR Kicks Off Digital Assets Consultation

The American Carbon Registry (ACR), a leading carbon offset crediting program, is exploring new opportunities in the carbon markets presented by digital innovations. ACR has been engaged with numerous Web3 companies interested in creating digital carbon assets based on ACR carbon offset credits.

These discussions have occurred bilaterally, between ACR and representatives of various coalitions, and via ACR’s participation in formal working groups, including the International Emissions Trading Association (IETA) Digital Climate Markets Task Force as well as in the Gold Standard Digital Working Groups.

In May 2022, ACR announced updated program rules prohibiting the tokenization of ACR carbon offset credits unless explicitly authorized by ACR. The updated rules were designed to protect the integrity of ACR offset credits and maintain confidence in carbon markets at this critical time for achieving climate action.

It is our intention to advance the dialogue around opportunities that digitization presents to the markets with the aim of developing program rules and infrastructure to support tokenization of ACR carbon offset credits. To that end, ACR invited participation in our Digital Assets Consultation to achieve two objectives toward progress:

- Share ACR’s current thinking around the risks and potential hurdles that need to be addressed.

- Gather information from a wide variety of proponents about how different offerings and technologies can best be structured and deployed to mitigate these concerns and advance climate goals.

The Digital Assets Consultation kicked off in September 2022 with background information and a first set of questions sent to participants. Topics being explored include:

- Proposed service offerings and how they advance climate action

- Maintaining environmental integrity of the carbon markets on-chain

- Market access, democratization, and transparency

- Blockchain security and the regulatory environment

ACR anticipates following up on the questionnaires with a second phase of bilateral conversations with consultation participants and potentially a convening at the end of the process. We appreciate that there are multiple angles from which to examine this subject and ACR is considering a third phase of engagement aimed at a wider audience to present and receive feedback from ACR account holders and other users on a variety of considerations that will ultimately shape ACR’s approach to digital assets. Sign up to receive the ACR newsletter and updates.

ACR Call for Expressions of Interest to participate in Digital Assets Consultation

ACR is issuing a request for Expression of Interest (EOI) to Web3 companies to participate in our Digital Assets Consultation. Alongside participation in other digital asset forums, the EOI aims to identify Web3 companies that wish to engage directly with ACR during the consultation to exchange information to inform the development of ACR’s program requirements and infrastructure for digital assets. This includes development of rules governing ACR’s authorization of the creation of digital carbon assets via the tokenization of ACR-issued credits; the required registry infrastructure to ensure transparency, security, and avoid double selling and double claims; and the consideration of legal and regulatory implications along the carbon value chain.

ACR is also participating in the IETA Digital Climate Markets Task Force, including the development of a Code of Best Practice for the tokenization of carbon credits and the use of tokenized carbon credits as well as in the Gold Standard Working Group on Digital Assets for Climate Impact with similar objectives. The aim of ACR’s broad collaboration with carbon market stakeholders is to establish a common implementation roadmap to safeguard the structural, legal and environmental underpinnings of carbon markets, while optimizing climate impact and access to finance.

If you wish to participate please respond to the EOI by submitting your company name and contact information to ACR@winrock.org with the subject line ‘Digital Assets Consultation EOI’ before August 5th.

ACR Ups the Ante for Rigor and Transparency with Updates to its Improved Forest Management Methodology

LITTLE ROCK, 13 July 2022 — The American Carbon Registry (ACR) has published an updated version of its Methodology for Improved Forest Management (IFM) on Non-Federal U.S. Forestlands, strengthening rigor and clarity, and further ensuring the methodology delivers real climate benefits, both now and over the long-term.

“ACR’s IFM methodology v2.0 combines more than 12 years of practical project implementation experience with the latest in carbon market innovation. It is based on forest economics and rooted in science, verifiability, and transparency. As the forest carbon market continues to expand in the U.S., incorporating more kinds of landowners than ever before, it is important that our methodology keep pace with these developments to ensure the scientific rigor of climate impacts,” said Mary Grady, Executive Director of ACR.

IFM projects attach a financial value to the carbon sequestration benefits of forests, allowing landowners to meet or supplement their revenue goals while achieving a higher standard of sustainable forest management. They incentivize landowners to forgo intensive harvesting or selling off timberlands, and instead allow forestland owners to monetize the value of carbon sequestration. IFM offers an immediate, scalable, and cost-effective strategy to mitigate climate change now, as the economy transitions toward net-zero by mid-century.

The ACR IFM methodology was originally published in 2011 and is now in its fourth iteration. Over 100 projects have enrolled under the ACR IFM methodology resulting in the issuance to date of 10 million tonnes of CO2e emission reductions and removals, equivalent to offsetting the emissions of approximately 200,000 passenger vehicles each year.

“With more than 3 million acres of U.S. forestland enrolled in the ACR IFM program, and another 4 million acres of forest carbon offset projects overseen by ACR as an approved Offset Project Registry for the State of California’s cap-and-trade program, ACR’s expertise comes from experience. This is a critical decade for climate action. Carbon markets are evolving, and ACR continues to refine our approaches to set the highest bar for carbon offset quality. Our portfolio has achieved incredible impact, and we’re excited for this next chapter in IFM,” said Kurt Krapfl, Director of Forestry at ACR.

Key changes to the new version of the ACR IFM methodology include updates to additionality safeguards; increased reporting requirements; further specificity in project accounting, modeling, and verification; and specific accounting of IFM “removals” credits.

The fully approved methodology, process documentation, and change log can be found here.

ACR Updates Program Rules for Tokenization of Carbon Credits

LITTLE ROCK, Ark., May 30, 2022 – The American Carbon Registry (ACR), a nonprofit enterprise of Winrock International, has announced updated program rules, effective immediately, that prohibit the tokenization of ACR carbon offset credits unless explicitly authorized by ACR. The updated rules, detailed in the legal Terms of Use agreement with ACR account holders, are designed to protect carbon asset integrity, including by ensuring that ACR-issued credits are not double sold or used by more than one entity to make environmental claims.

Concerns about blockchain’s role in the carbon markets has been amplified in the recent months amid the swift emergence of a crypto carbon market, in which millions of carbon credits have been retired, tokenized and converted to cryptocurrencies.

“Over the course of the last year, we have been in discussions with a number of companies interested in utilizing a range of technologies to streamline the credit creation process as well as to create digital carbon assets such as tokens and carbon-backed cryptocurrencies. While interested in the opportunities that these and other digital technologies offer to create efficiencies in carbon measurement, monitoring, reporting and verification, and to democratize access to markets, we are committed to a rigorous assessment process to ensure that they don’t undermine the foundations of carbon market integrity,” said Mary Grady, the Executive Director of ACR.

“As things stand at the moment, we believe the new link between carbon markets and unregulated cryptocurrencies presents a reputational vulnerability that could jeopardize confidence in carbon markets at precisely the time we need scale and transparency for markets to help achieve Paris Agreement climate targets,” Grady added.

ACR’s newly announced rules are the first step in the development of a set of program guardrails to protect market integrity. Alongside its own efforts to understand the risks and opportunities, as well as what rules would need to be in place for the creation of digital carbon assets, ACR has participated in the International Emissions Trading Association (IETA) Council Task Group on Integrity in Digital Climate Markets, launched earlier this year, which seeks to ensure sound foundations for the integration of carbon markets with digital technologies. The task group has already issued a set of principles to ensure integrity in digital carbon market offerings.

Over the coming months, ACR will build on the IETA principles and collaborate with carbon market participants with the aim of establishing a common implementation roadmap to safeguard the structural, legal and environmental underpinnings of carbon markets, while optimizing climate impact and access to finance. This will include program rules to authorize the tokenization of credits; developing the required registry infrastructure to ensure transparency and avoid double selling and double claims; and the implementation of appropriate legal and regulatory considerations along the carbon value chain.