This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

News Category: Program Announcements

ACR Approves First-of-a-Kind Carbon Crediting Methodology for Plugging Orphaned Oil and Gas (OOG) Wells

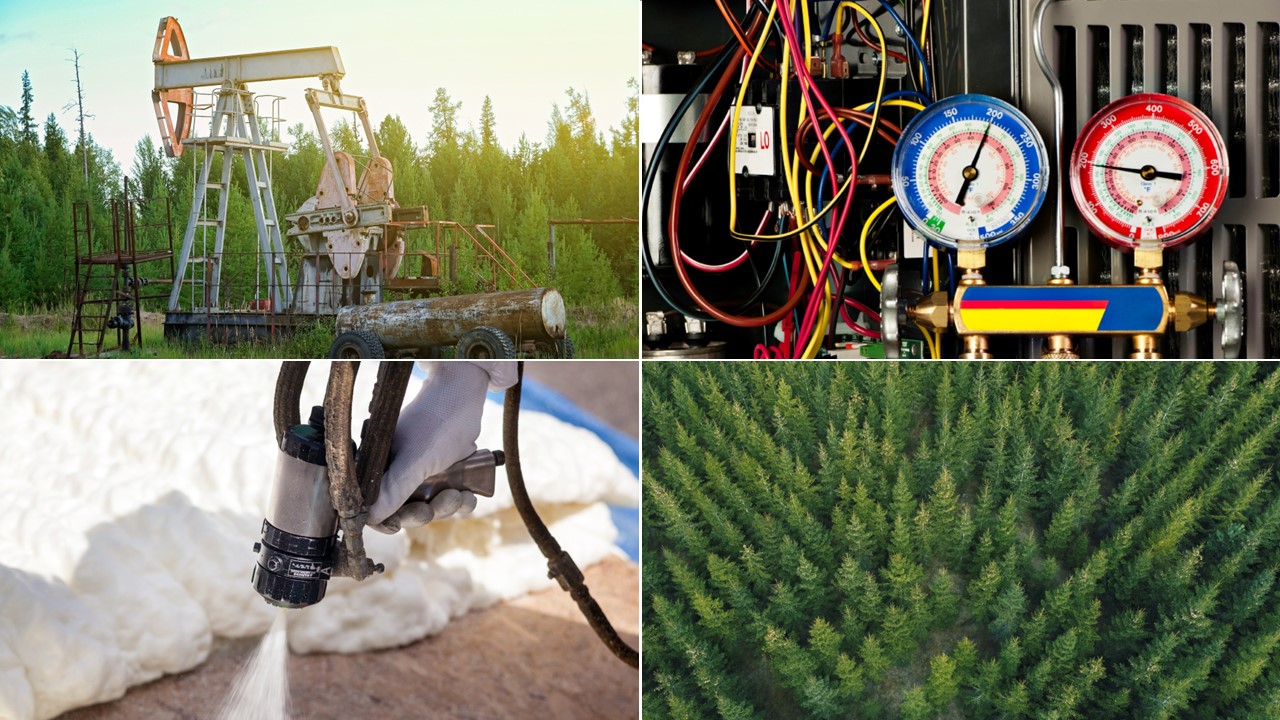

LITTLE ROCK, Ark., May 24, 2023 – The American Carbon Registry (ACR), a nonprofit enterprise of Winrock International, has published the world’s first methodology to leverage carbon market finance to plug orphaned oil and gas (OOG) wells in the United States and Canada. In the U.S. alone, the Environmental Protection Agency (EPA) estimates methane emissions from abandoned wells, of which orphaned wells are a subset, to be at least 7 million metric tons of CO2 equivalent annually, which is likely an underestimate. While U.S. government funding is available to plug orphaned wells, it is woefully inadequate to address the issue with estimates of a funding gap of many tens of billions of dollars.

The ACR Methodology for the Quantification, Monitoring, Reporting and Verification of Greenhouse Gas Emission Reductions from the Plugging of Orphaned Oil and Gas (OOG) Wells – developed in partnership with Dr. Mary Kang of McGill University, one of the world’s foremost experts on the topic – provides the eligibility requirements and accounting framework for the creation of carbon credits from the reduction in methane emissions by plugging OOG wells.

Orphaned wells are unplugged, inactive and have no solvent owner of record. Many of these wells have fallen into advanced states of disrepair and are leaking methane, a potent greenhouse gas. Unplugged wells can also leak other toxic chemicals that lead to air pollution, groundwater contamination, soil degradation, damage to ecosystems, and risk of explosions.

While oil and gas operators are required to plug wells at the end of their productive lives, more than 160 years of oil and gas operations has left the legacy of a huge number of orphaned wells in the U.S. and Canada, for which no operator exists. In these cases, responsibility for plugging the wells falls to states/provinces, federal agencies or Native American tribes, which have historically lacked the funding needed to address the problem in a meaningful way.

“The ACR methodology is designed to address the enormous gap in the existing resources to plug orphaned wells. It is intended to incentivize the plugging of leaking oil and gas wells in the U.S. and Canada, creating a pathway for carbon markets to help finance this activity for maximum climate impact,” said Mary Grady, Executive Director of ACR.

OOG wells pose a serious climate threat. Researchers at McGill University, together with the Environmental Defense Fund (EDF), have produced a map of 120,000 documented OOG wells across 30 states in the U.S. However, estimates of additional undocumented OOG wells range as high as several million across the country. Because of this, the United States Environmental Protection Agency (EPA) classifies abandoned wells, of which orphaned wells are a subset, as one of the most uncertain sources of methane emissions in the US, estimating 7-20 million metric tons of CO2 equivalent annually.

“It is highly likely that we are vastly underestimating the climate impact of OOG wells because of a basic lack of information. One of our main ambitions with this methodology is to help drive investment in innovation and technology, which in turn leads to the collection of more data. Our hope is that as we better understand the extent of this problem, legislative and other solutions can be developed that will help to address the challenge based on a stronger understanding of what it will take to solve it,” said Maris Densmore, ACR’s Director of Industrial Solutions.

Proper plugging and remediation of all U.S. and Canadian OOG wells is now an extremely large financial burden for local and federal governments, and there are significant backlogs because of lack of resources, equipment, and experienced personnel. While roughly $4.7 billion in funding was made available through the REGROW Act (part of the 2021 Infrastructure Investment and Jobs Act), a Columbia University report estimates that the cost of plugging a mere 500,000 wells could be as high as $24 billion. Carbon markets can provide financial incentives for additional action that complements other private, philanthropic, state and government led initiatives.

“While not a silver bullet, carbon finance can provide an innovative contribution by offering an additional source of funding. It will prioritize plugging the wells that are emitting the highest levels of methane, promoting a long-term solution with results that are measured, monitored and verified over the course of decades,” Densmore said.

The potential costs for capping wells vary widely. While carbon credit purchases may be enough to cover the full costs of capping some wells, most funding will be supplemental to additional state, non-profit and federal funding for well capping. Each state has different rules and regulations that will determine whether participating in the carbon market is the right investment. For some states the contribution to bonds to cover the costs of wells may be adequate, but that isn’t guaranteed now or in the future.

ACR Announces Public Comment Period for ACR Standard v8.0

LITTLE ROCK, Arkansas, May 1, 2023 – ACR, a nonprofit enterprise of Winrock International, announces an open public comment period for updates to the ACR Standard, which details ACR’s requirements and specifications for the quantification, monitoring, reporting, verification, registration and issuance of project-based GHG emission reductions and removals as carbon credits.

Proposed updates to the ACR Standard from version 7.0, published December 2020, to version 8.0 were previously posted for public comment in November 2021. This May 2023 public comment version reflects ACR’s responses to the first round of public comments as well as additional programmatic clarifications.

Key updates include codifying ACR’s existing scope exclusion for projects that displace one type of fossil fuel to another type of fossil fuel and projects that lock-in long-term GHG emissions; clarifying requirements to use ACR templates for key project document submissions; detailing the specification of environmental and social risk assessment requirements and the use of ACR tools and templates; and significantly enhancing the Complaints and Appeals process to detail the scope of complaints, the stepwise process for evaluation, investigation and resolution including timelines, and the requirements and process for appeals.

A detailed summary of changes is provided on the ACR website.

Please submit written comments to ACR@winrock.org with the subject line “ACR 8.0 Public Comments” by June 2, 2023.

ACR Standard 8.0 will go into effect July 1, 2023.

Application Window Open for the Hunter Parks Conservation Fellowship at ACR

LITTLE ROCK, Arkansas, April 20, 2023 – American Carbon Registry (ACR), a nonprofit enterprise of Winrock International, announces the opening of the application window for candidates for the Hunter Parks Conservation Fellowship at ACR. The Fellowship, established jointly with Green Assets in remembrance of the organizations’ business colleague, founder, and dear friend, was announced last month and to advance Hunter’s conservation vision.

The two-year Fellowship will be awarded to a recent forestry graduate on a competitive basis. The Fellow will engage on a day-to-day basis with forestry and carbon market experts in the evaluation of forest carbon project design and implementation to support the ongoing work to harness the power of carbon markets to conserve, sustainably manage and restore forestlands across the U.S.

Hunter founded Green Assets Inc., a forest carbon project development firm, in 2009 with the goal of providing landowners the opportunity to bring environmental and economic value to their property through conservation projects. Hunter’s absolute passion for conservation was evident in everything he did. As a landowner himself, he learned by doing and aimed to ensure that other landowners interested in tapping carbon markets for conservation finance had a trustworthy partner. The company’s mission is summed up by its motto of ‘Landowners working with Landowners.’ Following Hunter’s vision, the organization guides the development of projects, programs, and methodologies to meet the goals of landowners, while establishing a foundation of integrity in the marketplace.

The Hunter Parks Fellowship at ACR aims to continue to provide opportunity for growth in the forest carbon space by selecting a candidate who embodies Hunter’s passion for conservation, of exploring the unknown, and ensuring landowners get a fair, sustainable deal when participating in the carbon market, while promoting quality and integrity.

To read more about the Fellowship and to apply for consideration, please visit Winrock’s job site: https://grnh.se/db6d7aad2us

ACR Approved by ICAO Council for 2024-2026 Compliance Period

ACR — together with fellow Winrock enterprise Architecture for REDD+ Transactions (ART) — are the first two crediting programs approved to supply credits for first phase of CORSIA.

LITTLE ROCK, March 31, 2023 – The International Civil Aviation Organization (ICAO) Council, the UN’s main aviation body, has approved the American Carbon Registry (ACR) to supply carbon credits for the first phase of CORSIA, which commences in 2024.

Earlier this week, ACR was notified by the ICAO Council that it had been approved to supply CORSIA-eligible emissions units for the 2024-2026 compliance period. Eligible credits include those issued to activities that started their first crediting period on or after January 1, 2016 and that represent emissions reductions that occurred from January 2021 through December 2026.

ACR is once again one of the first crediting programs to receive approval to supply credits for a new phase of CORSIA. In this case, it is one of the first two crediting programs to receive approval for the 2024-2026 compliance period, the other being the Architecture for REDD+ Transactions (ART); both are enterprises of Winrock International. In 2021, ACR and ART were the first crediting programmes to be approved to offer post-2020 vintage credits for CORSIA’s 2021-2023 pilot phase.

“We are proud that ACR has once again successfully completed a thorough review of our program requirements and oversight,” said Mary Grady, Executive Director of ACR. “Ensuring carbon market integrity is paramount to our mission, and this this approval reflects our commitment to ensure our procedures continue to improve and evolve in line with Paris Agreement rules alongside increased scrutiny, oversight and guidance in the marketplace.”

ICAO is a specialized agency of the United Nations that manages the standards that govern international aviation. In 2016, ICAO approved the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) as a global market-based mechanism to achieve carbon-neutral growth in international aviation starting in 2020. CORSIA is expected to reduce or offset between 2.5 and 4 billion tons of CO2-e through 2035.

Initially approved by ICAO in 2020 to supply eligible pre-2020 ACR-issued credits for the 2021-2023 pilot phase, ICAO expanded ACR’s eligibility in 2021 to supply post-2020 credits for use in the pilot phase. This updated approval for Paris Agreement-aligned credits, which ACR was the first to receive, was based on ACR’s ability to demonstrate that it would ensure avoidance of double counting of credits used for CORSIA with mitigation targets under the Paris Agreement. In the context of climate change mitigation, double counting describes situations where a single greenhouse gas emission reduction or removal is used more than once to demonstrate compliance with mitigation targets.

This latest approval for CORSIA’s first phase comes alongside the release by the Integrity Council for the Voluntary Carbon Market (ICVCM) of its Core Carbon Principles (CCPs), a set of fundamental principles for high-quality carbon credits. ICVCM’s requirements for crediting programs, such as ACR, have been streamlined for ICAO-approved programs to build on existing CORSIA requirements, with additional criteria around effective governance, credit tracking, transparency and robust, independent third-party validation and verification.

“ACR looks forward to continuing to be at the vanguard of market innovation and impact, and to working with the broad range of stakeholders who share our desire to create confidence in the environmental and scientific integrity of high quality carbon credits in order to accelerate transformational climate action,” Grady said.

ACR Approved as Offset Project Registry (OPR) for the State of Washington's Cap-and-Invest Program

LITTLE ROCK, Arkansas March 27, 2023 – The American Carbon Registry (ACR), a nonprofit enterprise of Winrock International, has been approved as one of the first Offset Project Registries (OPRs) for the State of Washington’s Cap-and-Invest Program.

The program sets a limit, or cap, on overall carbon emissions in the state and requires businesses to obtain allowances equal to their covered greenhouse gas emissions. In the first compliance period, 2023-2026, participating entities can cover up to 5% of their emissions with carbon credits, and can cover an additional 3% with credits from projects on federally recognized Tribal lands.

As an OPR, ACR will work with Washington’s Department of Ecology to oversee the listing and verification of carbon offset projects developed following the Department’s approved offset protocols. ACR-issued Registry Offset Credits are then eligible to be converted to Ecology Offset Credits that may be used by capped entities to meet a portion of emissions reduction obligations under the Cap-and-Invest Program.

“We are thrilled to support Washington State’s Cap-and Invest Program, which is designed to reduce climate pollution and help the state meet its climate goals. The approval signals that we have met stringent regulatory requirements including technical expertise in carbon offset protocols; extensive experience in the oversight of offset project listing, registration, independent third-party verification; the issuance of serialized credits on a transparent registry; and a solid understanding of the regulation underpinning the compliance offset program,” said Mary Grady, Executive Director of ACR.

This follows an announcement last month that ACR has signed a Memorandum of Understanding (MoU) with the National Environment Agency (NEA) of the Government of Singapore that will allow Singaporean companies to use ACR-issued carbon credits to offset up to 5% of their taxable emissions starting in 2024. ACR has also served as the leading approved OPR in California’s Cap-and-Trade Program since 2012.

“ACR, which has a long tradition of supporting ambitious climate results, is pleased to be working with federal and state governments around the world that are leading efforts to explore that role that carbon credits can and should play within compliance regimes in support of catalyzing well-functioning carbon markets,” Grady said.

2022 ACR Updates

Major 2022 ACR Program Updates

ACR has linked with AirCarbon Exchange (ACX)

ACR Account Holders can now list Emission Reduction Tons (ERTs) for sale on AirCarbon Exchange (ACX). Through this partnership, ACR Account Holders can offer ERTs on ACX’s Auctions platform and also facilitate back-to-back Over-the-Counter (OTC) ERT transactions through ACX.

Launch of updated Methodology for Improved Forest Management (IFM) on Non-Federal U.S. Forestlands

ACR has revised our Improved Forest Management (IFM) on Non-Federal U.S. Forestlands methodology to include further additionality safeguards; increased reporting requirements; further specificity in project accounting, modeling, and verification; and specific accounting of IFM “removals” credits.

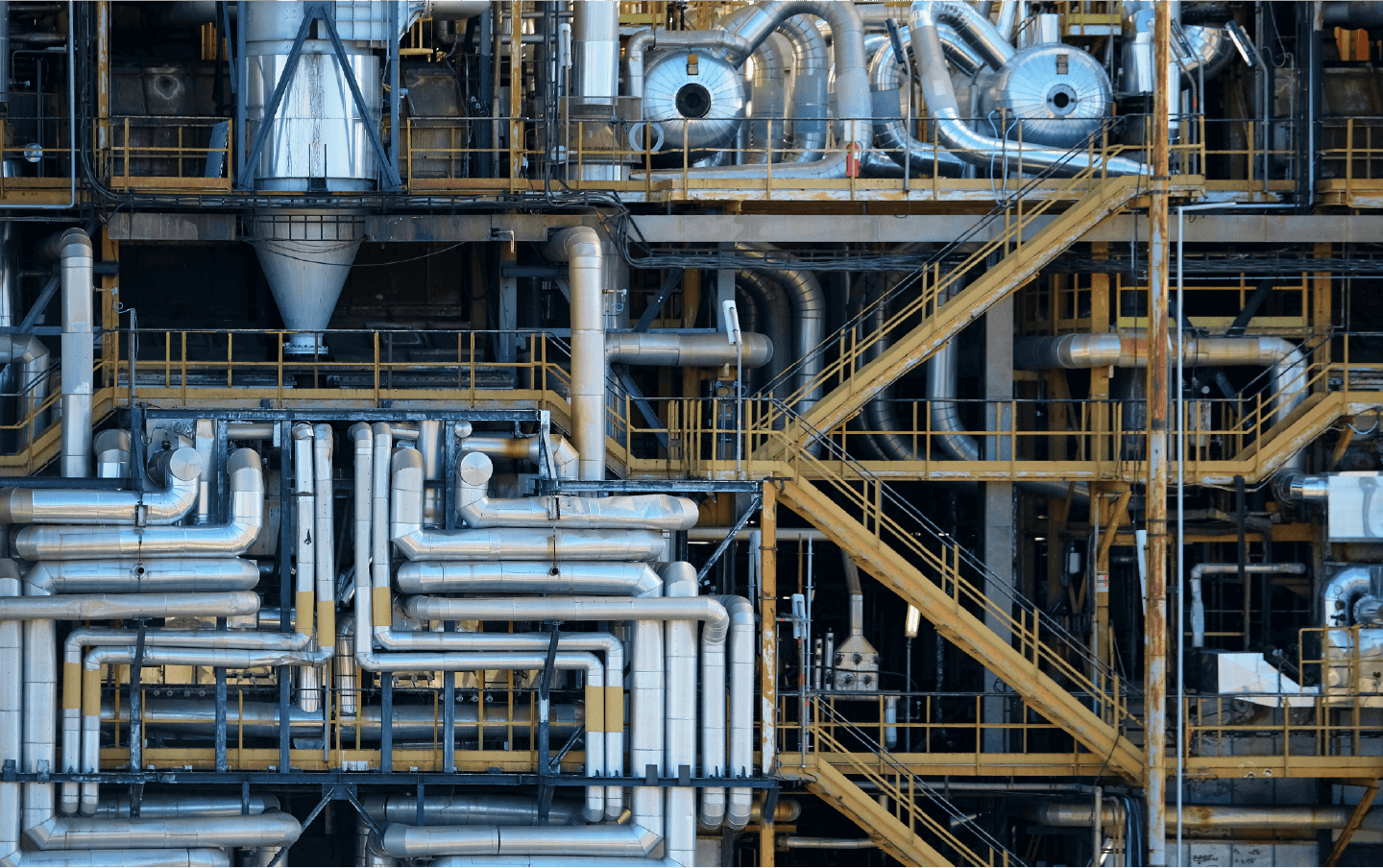

ACR Launches Innovative Registry Infrastructure for Removal Credits

ACR is the first registry that has implemented functionality to label credits verified as “removals” for project types including afforestation/reforestation (A/R), Improved Forest Management (IFM) and Carbon Capture and Storage (CCS). Now IFM and CCS projects can generate both emission reductions and removals to distinguish between the two upon credit issuance.

ACR to lead $20M USDA climate-smart agriculture commodities and markets project

The U.S. Department of Agriculture (USDA) has chosen Winrock International and ACR to implement a $20 million project supporting farmers and ranchers to adopt climate-smart practices and capitalize on their climate value by certifying and monetizing results in commodity markets.

ACR AT COP27

Article 6 and The Voluntary Carbon Market: Tools To Deliver NDCs and Increase Ambition At COP27, ACR’s Executive Director, Mary Grady moderated an event on the intersection of Article 6 and the voluntary carbon market in front of a packed house. She helped lead a fascinating discussion around integrity, transparency, and clarity that touched on how governments are considering the application of corresponding adjustments for voluntary carbon market transactions, and associated timelines, as well as the price premiums that may be attached to credits that carry such a corresponding adjustment. Recent Trends In U.S. Forest Carbon Market: Growth, Quality, and Expectations For The Future Kurt Krapfl, ACR’s Director of Forestry, moderated a panel at COP27 on the U.S. forest carbon market. Kurt was joined by Jessica Orrego from Mercuria, John McDougal from Anew, Bailey Evans from Green Assets, Inc., and Jeremy Manion from Arbor Day Foundation / Arbor Day Carbon to discuss some of the latest trends. The panel covered how opportunities are expanding to more types of land owners, including small private landowners; what constitutes quality and what to look out for; the innovations that are creating new efficiencies in the market; and what buyers are looking for in forest carbon credits, among other topics. Carbon Offsets and CCUS Mary Grady spoke on a panel hosted by the Kingdom of Bahrain on CCS, with colleagues from Latham and Watkins, Air Product and Perspectives Climate Group to discuss emerging technologies and share ACR’s perspective for how carbon markets can incentivize CCS projects that generate real, quantifiable and permanent voluntary carbon credits that accelerate a just energy transition. Getting To Net Zero: The Critical Role of Addressing Non-Co2 Gasses ACR’s Maris Tabor Densmore, Director of Engineered Solutions and Industrial Team Lead, and Megesh Tiwari, Senior Technical Manager, joined Geoffrey Gordon-Creed of Well Done Foundation and Tim Brown of Tradewater at the International Emissions Trading Association pavilion at COP27 to discuss the rapid reduction of non-CO2, high global warming potential (GWP) greenhouse gasses (GHGs).

Role of Financial Organisations and Carbon Markets In Accelerating CCS Deployment

Maris Densmore joined a COP27 panel at the International Emissions Trading Association pavilion with Guloren Turan of Global CCS Institute, Dirk Forrister of International Emissions Trading Association, Zoë Knight of HSBC and Fatih Yilmaz of KAPSARC to discuss the role of CCS in the path to net zero.

Overview of US Voluntary Carbon Market and Leading Project Types

Mary Grady joined a panel at the the International Emissions Trading Association pavilion that explored leading project types in the U.S., from both existing and emerging technologies, as well as an overview of the U.S. carbon market—including a review of supply and demand trends. Panelists discussed buyer considerations that drive purchasing decisions, including key criteria, quality, and co-benefits.

METHODOLOGY UPDATES IN 2022

2022 NEWLY APPROVED METHODOLOGIES

Improved Forest Management (IFM) on Non-Federal U.S. Forestlands 2.0

Improved Forest Management (IFM) on Small Non-Industrial Private Forestlands 1.0

Improved Forest Management (IFM) on Canadian Forestlands 1.0

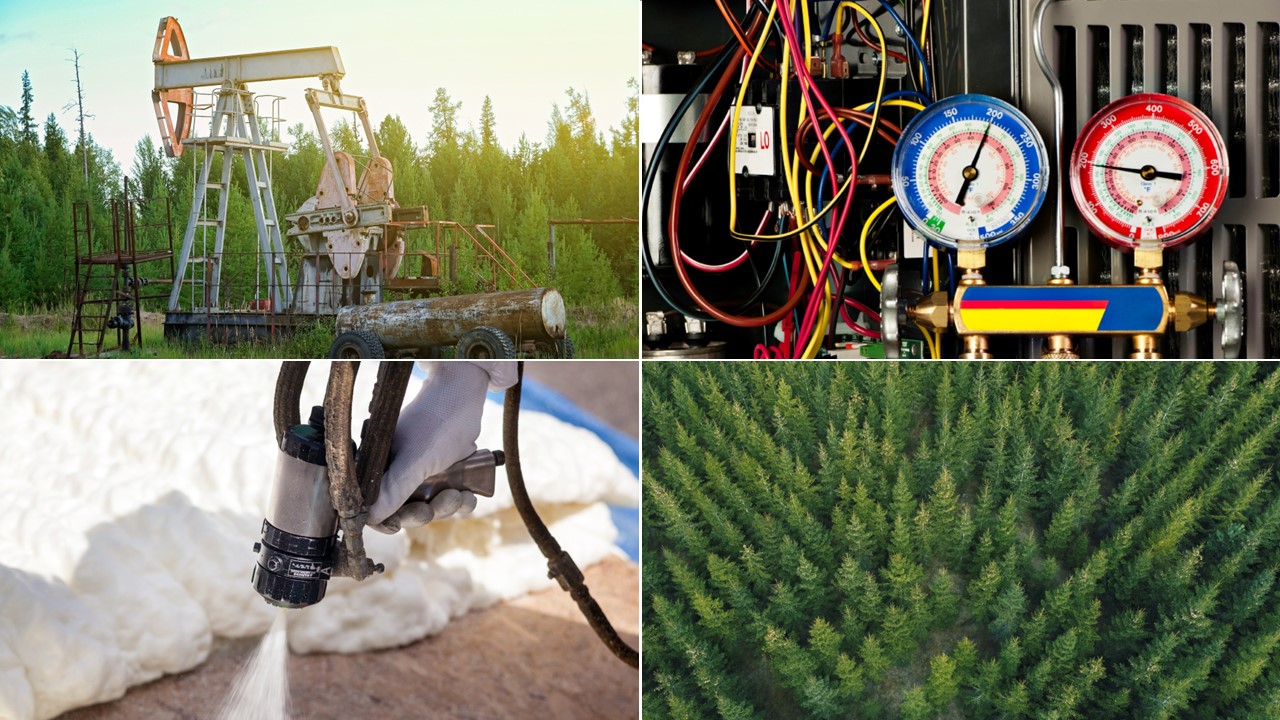

Destruction of Ozone Depleting Substances and High-GWP Foam 1.2

Destruction of Ozone Depleting Substances from International Sources 1.0

IN SCIENTIFIC PEER REVIEW

Plugging Abandoned & Orphaned Oil and Gas Wells 1.0

Destruction of Ozone Depleting Substances and High-GWP Foam 2.0

Avoiding Conversion of U.S. Forests 1.0

Carbon Capture and Storage 2.0

ACR IN THE NEWS IN 2022

Here’s how to incentivize cleaning up landfills — the culprit driving one-fifth of global warming [Opinion] MarketWatch, Mary Grady and Megesh Tiwari, 31 October Blue carbon will be the next frontier of carbon crediting GreenBiz, Jesse Klein, 9 November Air-conditioner use will jump 280% in the next decades. How can we keep cool without making climate change worse? [Opinion] MarketWatch, Mary Grady, 9 August Little Rock nonprofit aims to standardize climate benefits for farmers Axios, Worth Sparkman, 19 September Carbon offsets have serious issues. Is it even possible to fix them? Fast Company, Adele Peters, 24 August Are carbon offsets a joke? A response to comedian John Oliver GreenBiz, Jim Giles and Jesse Klein, 30 August ACR emphasises additionality safeguards, carbon removals accounting in updated IFM methodology Carbon Pulse, Matt Lithgow, 13 July ACR to distinguish improved forest management projects that generate “removal” credits Carbon Pulse, Katherine Monahan, 18 April Operators May Earn and Sell Carbon Credits for the P&A of Inactive, Shut-in, or Temporarily Abandoned Wells JD Supra, Court VanTassell and Juliane Mahoney, 21 June State lands open for carbon crediting, but how good are those credits?GreenBiz, Jesse Klein, 2 MayAs disputes around logging increase, First Nations eye carbon credits as a way to generate revenue Globe and Mail, Jeffrey Jones, 19 January RESOURCES In 2022, ACR developed a series of blogs and primers to introduce some of the key challenges and opportunities in the realm of climate action that our methodologies are designed to address. In each primer, we introduce the challenge or the opportunity and explain how carbon market incentives can help unlock the solution. Carbon Capture and Storage Primer Foam Blowing Agents PrimerMethane Emissions from Landfills Primer

Ozone Depleting Substances Primer ACR Improved Forest Management (IFM): A Primer ACR Carbon Markets 101: Additionality and Baselines for Improved Forest Management Projects ACR Carbon Markets 101: High GWP PollutantsACR has linked with AirCarbon Exchange (ACX)

ACR Account Holders can now list Emission Reduction Tons (ERTs) for sale on AirCarbon Exchange (ACX). Through this partnership, ACR Account Holders can offer ERTs on ACX’s Auctions platform and also facilitate back-to-back Over-the-Counter (OTC) ERT transactions through ACX.

To access this new opportunity, ACR Account Holders can contact ACX by email or can get started through the ACX website.

This partnership between ACR and ACX expands market access for ERTs to ACX participants who may not have accounts with ACR. ACX is pleased to provide this service to ACR Account Holders and both parties look forward to continuing to broaden the offerings available to buyers and sellers in the future.

ACR Extends Stakeholder Consultation for CCS Methodology v2.0

Due to the high volume of interest in the ACR CCS methodology v2.0, ACR announces an extension of the stakeholder consultation period to November 30, 2022.

Please send comments to ACR@Winrock.org with the subject line “CCS Methodology Version 2.0 Public Comments.”