This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Open Letter to Future Carbon Credit Buyers

SOCIAL MEDIA GRAPHICS TO SHARE BELOW.

Dear Future Carbon Credit Buyers:

Carbon credits are essential climate solutions because every business has an unavoidable carbon footprint. That is why “net zero” is a pragmatic goal in line with the Paris Agreement1, while “absolute zero” is unrealistic, now and until there are drastic advancements in decarbonization at scale.

Now is the time for companies to take greater responsibility for the emissions they cannot reduce by purchasing and retiring high-quality carbon credits. Reduce and invest is a new strategic mantra for every business leader.

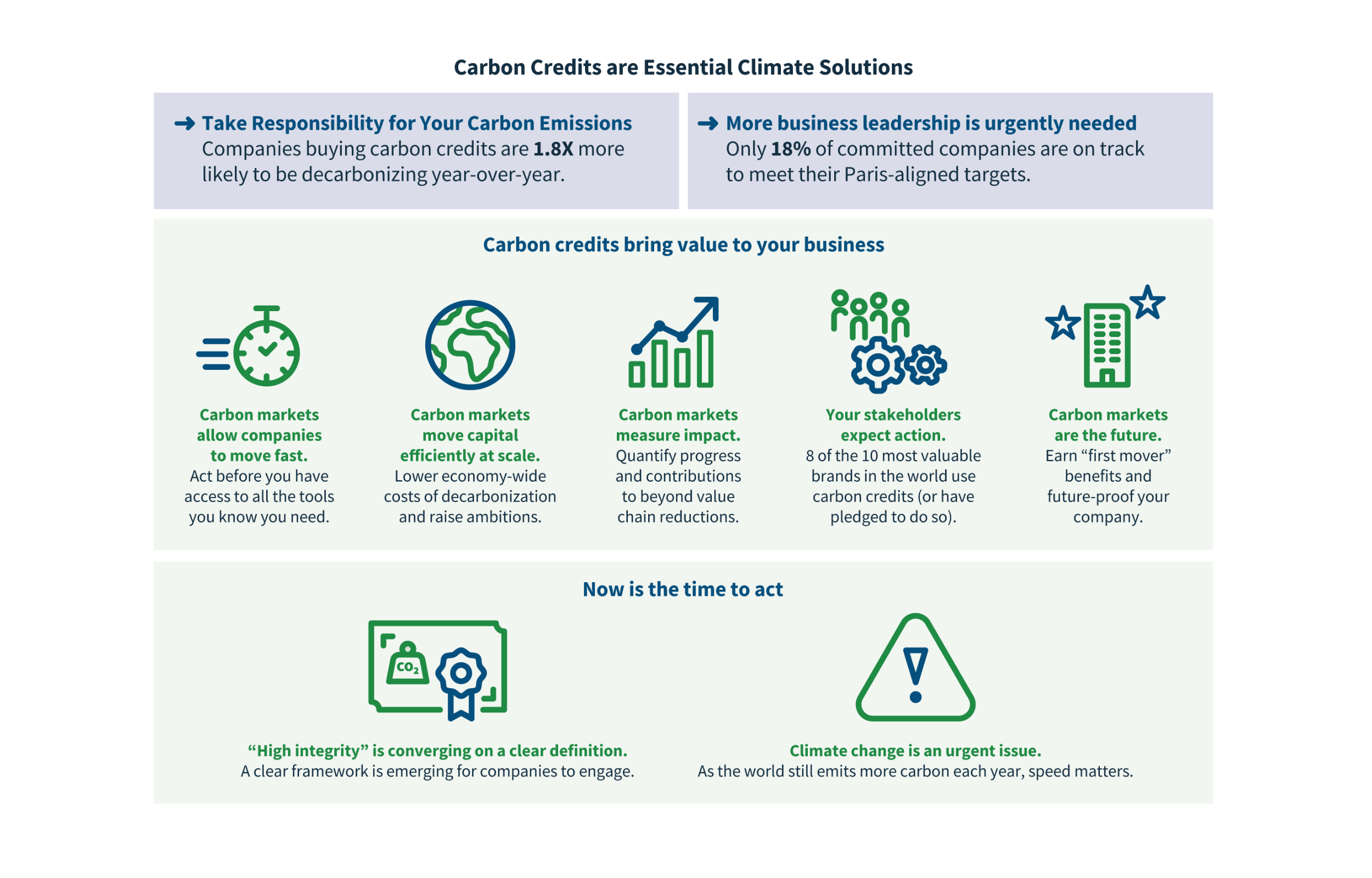

Companies that are already utilizing carbon credits are 1.8 times more likely to be decarbonizing year-over-year2, a key to achieving net-zero emissions by 2050. There are two reasons for this: Companies using credits likely have a diverse portfolio of climate actions, including decarbonization. And by purchasing credits, companies put a price on their carbon emissions, which creates further incentive to decarbonize.

The world will only meet the goals of the Paris Agreement (and public expectations) if all businesses take comprehensive climate action. This means prioritizing emissions reductions within their value chains while also investing in additional mitigation activities to take responsibility for residual emissions, including through the use of high-quality carbon credits.

Corporate climate action is largely voluntary, however many companies are already committed, setting Paris Agreement-aligned targets and decarbonizing their scope 1, 2 and 3 emissions to the greatest extent possible. Yet even among committed companies only 18% are on track to achieve their targets, according to Accenture3.

Purchasing carbon credits can help companies and the planet get back on track. Investing in a diverse portfolio of credits, including both nature-based and engineered solutions, can reduce nature loss and advance actions with immediate impact. Nature is essential for maintaining a thriving economy; 55% of global GDP depends on natural capital and ecosystem services4, making natural climate solutions an important part of a portfolio. Done well, both natural climate solutions and engineered solutions can also provide positive socio-economic benefits for Indigenous Peoples and communities local to project areas. Projects targeting super-pollutants that have much greater near-term harm, such as methane and refrigerants, have immediate benefits and buy the world time to address hard-to-abate sectors like heavy industry and transportation.

Carbon markets are not perfect. The science, technology, data and market expectations underpinning high-integrity climate action continue to evolve and become more consistently regulated. However, the fact remains that the urgency of climate change calls for action now, as broadly supported initiatives reinforce requirements for carbon market integrity.

A decision to buy carbon credits requires a strong case showing that the business benefits of buying carbon credits outweigh the risks.

Here’s how carbon credits bring value to your organization:

- Carbon markets allow companies to move fast. Markets let you act before you have access to all the tools you know you need. In a recent survey of 500 business leaders, the top benefit of carbon markets was that they allow “immediate climate action while working to reduce emissions in the longer term.”5 Buying carbon credits from projects with verified emissions reductions and removals creates immediate impact, even as companies prioritize supply chain decarbonization.

- Carbon markets move capital efficiently at scale. Buying carbon credits is efficient, lowering economy-wide costs of decarbonization and raising ambitions and impact, according to research from Environmental Defense Fund6. Carbon markets can also move capital at scale. For example, more than $100 billion was invested in carbon markets in 2023, which is a record according to the World Bank7. By comparison, all climate philanthropy was estimated to be $7.8 – 12.8 billion in 20228. To achieve net-zero emissions by 2050, more than $3.5 trillion in additional average annual spending will be required, according to McKinsey9. Only private markets can move capital at that speed and scale.

- Carbon markets measure impact. Carbon markets are laser-focused on measuring emissions reduced or removed. For most companies, scope 3 emissions account for more than 70% of their total emissions and most companies with Paris Agreement-aligned targets are not meeting their scope 3 targets10. Carbon markets offer ways to quantify progress and contributions beyond value chain emission reductions, with rigorous measurement, monitoring, reporting and independent verification, alongside work to decarbonize.

- Your stakeholders expect action. 90% of employees engaged in their company’s sustainability work say it enhances their job satisfaction11 because people want to work for responsible businesses. Consumers expect companies to act. Carbon credits show a level of maturity in your decarbonization journey, which is why 8 of the 10 most valuable brands in the world already are using carbon credits or have pledged to do so12.

- Carbon markets are the future. All companies are likely to participate in carbon markets at some point in the future13. Acting now offers “first-mover” benefits as markets develop. To address material business risks, as a defensive posture against future regulation, price increases, and reporting requirements, and as a proactive investment in new business systems and opportunities, buying carbon credits now helps to future-proof your company.

Here’s why now is the time to act:

- Carbon market integrity is converging on a clear definition. Across civil society and governmental bodies and private organizations, definitions of “high-integrity” are now widely shared and integrated into carbon markets. While there is more work to do, a clear framework is emerging for companies to engage. Demand inherently pushes markets towards integrity and rewards quality. With a clear definition in place for high-integrity carbon credits, your company’s support means engagement and improvement in the local communities in which you’re invested — in a measurable, third-party-verified way.

- Climate change is an urgent issue. It is already affecting all parts of our economy, from supply chain disruptions to employee health. In the climate fight, speed matters.

This letter is a call for pragmatic action now.

We, the undersigned, know from experience that carbon markets have a critical role to play alongside supply emissions reductions. We have seen how carbon credits can help companies decarbonize faster, with greater efficiency that increases ambition.

We encourage you to take the next step by including carbon credits in your sustainability strategy now. We stand ready to support your efforts. Don’t hesitate to contact us if we can be helpful in sharing our own experiences.

Sincerely,

Share the Letter & Graphics

Want to share this message? Download a .zip file with the open letter (.pdf) and graphics files for use on social media here.

Learn More

Want to dig into the research behind the open letter? ACR developed a white paper to support business leaders who are making a case that the business benefits of buying carbon credits outweigh the risks. Download the white paper here.

Endnotes

1. UNFCCC, Unlocking Climate Ambition: the Significance of Article 6 at COP28, https://unfccc.int/news/unlocking-climate-ambition-the-significance-of-article-6-at-cop28

2. Ecosystem Marketplace, New research: Carbon credits are associated with businesses decarbonizing faster; https://www.ecosystemmarketplace.com/articles/new-research-carbon-credits-are-associated-with-businesses-decarbonizing-faster/

3. Accenture, Only a Fifth of Companies on Track for Net Zero, with Heavy Industry Key to Breaking Decarbonization Stalemate, Accenture Reports Find https://newsroom.accenture.com/news/2023/only-a-fifth-of-companies-on-track-for-net-zero-with-heavy-industry-key-to-breaking-decarbonization-stalemate-accenture-reports-find

4. PwC. PwC boosts global nature and biodiversity capabilities with new Centre for Nature Positive Business, as new research finds 55% of the world’s GDP – equivalent to $58 trillion – is exposed to material nature risk without immediate action, https://www.pwc.com/gx/en/news-room/press-releases/2023/pwcboosts-global-nature-and-biodiversity-capabilities.html#:~:text=More%20than%20half%20(55%25),is%20highly%20dependent%20on%20nature.

5. Conservation International & We Mean Business Coalition, Corporate Minds on Climate Action; https://www.conservation.org/docs/default-source/audio/download-the-report-here-.pdf?sfvrsn=eaece659_6

6. Environmental Defense Fund, How carbon markets can increase climate ambition, https://www.edf.org/climate/how-carbon-markets-can-increase-climate-ambition#:~:text=An%20economic%20analysis%20from%20Environmental,with%20their%20Paris%20Agreement%20targets

7. World Bank Group, Global Carbon Pricing Revenues Top a Record $100 Billion, https://www.worldbank.org/en/news/press-release/2024/05/21/global-carbon-pricing-revenues-top-a-record-100-billion

8. ClimateWorks Foundation, Report: In Sharp Reversal, Climate Giving Flat in 2022, https://www.climateworks.org/press-release/report-in-sharp-reversal-climate-giving-flat-in-2022/

9. McKinsey, The net-zero transition: What it would cost, what it could bring, https://www.mckinsey.com/capabilities/sustainability/our-insights/the-net-zero-transition-what-it-would-cost-what-it-could-bring

10. World Economic Forum, It’s time for companies to take on ‘scope 3’ emissions to tackle the the full climate impact of their products, https://www.weforum.org/agenda/2023/01/climate-change-emissions-scope-3-companies-esg/

11. Cloverly, 7 Benefits of Carbon Credits: How to Make the Business Case to the C-Suite, https://cloverly.com/benefits-of-carbon-credits-white-paper/

12. Carbon Growth Partners & Bloomberg, Investing in Carbon Markets: Cleared for Take-off, https://www.bloomberg.com/professional/insights/trading/investing-in-carbon-markets-cleared-for-take-off/

13. BloombergNEF, Long-Term Carbon Offsets Outlook 2023, https://spotlight.bloomberg.com/story/longtermcarbonoffsetsoutlook2023/page/2/2