This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Resources Tag: MARKET REPORT

Bending the Curve: TNC's vision for the role of carbon credits in corporate net zero

The Nature Conservancy puts forward a pragmatic vision for the role carbon credits can play in corporates’ transition to net zero, identifying four use cases:

- Close the near-term emissions gap: 2024-2035

- Address unabated emissions: 2035-2050

- Neutralize residual emissions: 2050-2080

- Take responsibility for historical emissions: 2050-2080

As the Conservancy notes, “we are in a climate emergency – and we need to act accordingly. Now is the time to expand the number of climate solutions available, not limit it.”

This fact-filled report serves as a valuable resource for carbon project developers and corporate leaders who are making the case for increased use of carbon credits on the path to net zero.

Art of Integrity: State of Voluntary Carbon Markets 2022 Q3

Pursuing quality during a period of explosive growth – VCM value in 2021 quadrupled over 2020! New Ecosystem Marketplace data shows that total market value for voluntary carbon markets transactions in 2021 was nearly $2B, with a surge in transactions coming late in the year. That is a nearly four-fold increase from 2020 transactions ($520 million).

Download Report from Ecosystem Marketplace

About Ecosystem Marketplace

Ecosystem Marketplace, an initiative of the non-profit organization Forest Trends, is a leading global source of information on environmental finance, markets, and payments for ecosystem services. As a web-based service, Ecosystem Marketplace publishes newsletters, breaking news, original feature articles, and annual reports about market-based approaches to valuing and financing ecosystem services. We believe that transparency is a hallmark of robust markets and that by providing accessible and trustworthy information on prices, regulation, science, and other market-relevant issues, we can contribute to market growth, catalyze new thinking, and spur the development of new markets and the policies and infrastructure needed to support them. Ecosystem Marketplace is financially supported by a diverse set of organizations including multilateral and bilateral government agencies, private foundations, and corporations involved in banking, investment, and various ecosystem services.

Research: Carbon credits are associated with businesses decarbonizing faster

Businesses purchasing voluntary carbon are more likely to report lower gross emissions year-on-year, and invest more in emissions reductions, than companies not engaged in carbon markets

Research from Ecosystem Marketplace suggests that companies that participate in voluntary carbon markets are leading across a range of measures of robust climate action, accountability, and ambition—across the board, outperforming companies that do not buy carbon credits.

The study indicates that not only are carbon credits purchases funding rapid climate action, but are also associated with companies that are already addressing climate change in their direct operations and throughout their value chains.

Findings include:

- Companies engaging in the voluntary carbon market are:

- 1.8X more likely to be decarbonizing year-over-year.

- 3.4X more likely to have an approved science based climate target.

- 3X more likely to include Scope 3 Emissions in their climate target.

Corporate emission performance and the use of carbon credits

Trove Research, a specialist data, analysis and advisory firm focused on corporate climate action, released a new report in June 2023 that found, “companies that are material users of carbon credits decarbonize twice as fast as those that do not use carbon credits.”

Based on an analysis of data from Trove’s database covering more than 10,000 firms, the 350 companies that used carbon credits from 2017-2022 decarbonized at an average rate of 6% annually, compared to 3% annual reductions for the 3,800 companies that did not use carbon credits. In addition, companies that used more carbon credits tended to decarbonize faster than others that did not use credits.

According to Trove, “the evidence of the last five years strongly suggests that the voluntary purchase of carbon credits provides companies an incentive to accelerate their emission reductions.”

Read the whole report on Trove Research’s website.

Beyond Beneficiaries: Fairer Carbon Market Frameworks

Companies are increasingly turning to carbon credits to complement their climate targets and to finance near-term reductions that are otherwise too costly or difficult to abate. This finance could be critical to scaling transformational climate benefits and positive social change – if done well.

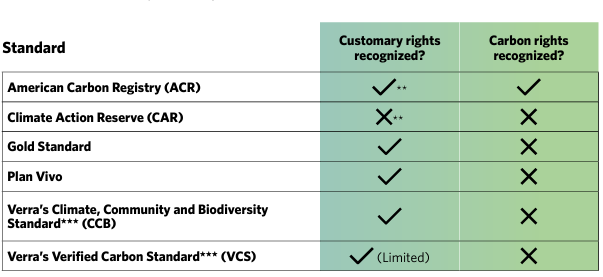

Because best practices in benefits-sharing with Indigenous Peoples and local communities can vary widely in different contexts, this report focuses exclusively on natural climate solutions projects that are intended for sale in the voluntary carbon markets, with a focus on those with Indigenous Peoples and Local Community involvement.

The report highlights how ACR is the only program to have published guidance specific to carbon project development on Tribal lands, which we developed jointly with the Indian Land Tenure Foundation.

Download the report from Nature4Climate.