This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

2022 ACR Updates

Major 2022 ACR Program Updates

ACR has linked with AirCarbon Exchange (ACX)

ACR Account Holders can now list Emission Reduction Tons (ERTs) for sale on AirCarbon Exchange (ACX). Through this partnership, ACR Account Holders can offer ERTs on ACX’s Auctions platform and also facilitate back-to-back Over-the-Counter (OTC) ERT transactions through ACX.

Launch of updated Methodology for Improved Forest Management (IFM) on Non-Federal U.S. Forestlands

ACR has revised our Improved Forest Management (IFM) on Non-Federal U.S. Forestlands methodology to include further additionality safeguards; increased reporting requirements; further specificity in project accounting, modeling, and verification; and specific accounting of IFM “removals” credits.

ACR Launches Innovative Registry Infrastructure for Removal Credits

ACR is the first registry that has implemented functionality to label credits verified as “removals” for project types including afforestation/reforestation (A/R), Improved Forest Management (IFM) and Carbon Capture and Storage (CCS). Now IFM and CCS projects can generate both emission reductions and removals to distinguish between the two upon credit issuance.

ACR to lead $20M USDA climate-smart agriculture commodities and markets project

The U.S. Department of Agriculture (USDA) has chosen Winrock International and ACR to implement a $20 million project supporting farmers and ranchers to adopt climate-smart practices and capitalize on their climate value by certifying and monetizing results in commodity markets.

ACR AT COP27

Article 6 and The Voluntary Carbon Market: Tools To Deliver NDCs and Increase Ambition At COP27, ACR’s Executive Director, Mary Grady moderated an event on the intersection of Article 6 and the voluntary carbon market in front of a packed house. She helped lead a fascinating discussion around integrity, transparency, and clarity that touched on how governments are considering the application of corresponding adjustments for voluntary carbon market transactions, and associated timelines, as well as the price premiums that may be attached to credits that carry such a corresponding adjustment. Recent Trends In U.S. Forest Carbon Market: Growth, Quality, and Expectations For The Future Kurt Krapfl, ACR’s Director of Forestry, moderated a panel at COP27 on the U.S. forest carbon market. Kurt was joined by Jessica Orrego from Mercuria, John McDougal from Anew, Bailey Evans from Green Assets, Inc., and Jeremy Manion from Arbor Day Foundation / Arbor Day Carbon to discuss some of the latest trends. The panel covered how opportunities are expanding to more types of land owners, including small private landowners; what constitutes quality and what to look out for; the innovations that are creating new efficiencies in the market; and what buyers are looking for in forest carbon credits, among other topics. Carbon Offsets and CCUS Mary Grady spoke on a panel hosted by the Kingdom of Bahrain on CCS, with colleagues from Latham and Watkins, Air Product and Perspectives Climate Group to discuss emerging technologies and share ACR’s perspective for how carbon markets can incentivize CCS projects that generate real, quantifiable and permanent voluntary carbon credits that accelerate a just energy transition. Getting To Net Zero: The Critical Role of Addressing Non-Co2 Gasses ACR’s Maris Tabor Densmore, Director of Engineered Solutions and Industrial Team Lead, and Megesh Tiwari, Senior Technical Manager, joined Geoffrey Gordon-Creed of Well Done Foundation and Tim Brown of Tradewater at the International Emissions Trading Association pavilion at COP27 to discuss the rapid reduction of non-CO2, high global warming potential (GWP) greenhouse gasses (GHGs).

Role of Financial Organisations and Carbon Markets In Accelerating CCS Deployment

Maris Densmore joined a COP27 panel at the International Emissions Trading Association pavilion with Guloren Turan of Global CCS Institute, Dirk Forrister of International Emissions Trading Association, Zoë Knight of HSBC and Fatih Yilmaz of KAPSARC to discuss the role of CCS in the path to net zero.

Overview of US Voluntary Carbon Market and Leading Project Types

Mary Grady joined a panel at the the International Emissions Trading Association pavilion that explored leading project types in the U.S., from both existing and emerging technologies, as well as an overview of the U.S. carbon market—including a review of supply and demand trends. Panelists discussed buyer considerations that drive purchasing decisions, including key criteria, quality, and co-benefits.

METHODOLOGY UPDATES IN 2022

2022 NEWLY APPROVED METHODOLOGIES

Improved Forest Management (IFM) on Non-Federal U.S. Forestlands 2.0

Improved Forest Management (IFM) on Small Non-Industrial Private Forestlands 1.0

Improved Forest Management (IFM) on Canadian Forestlands 1.0

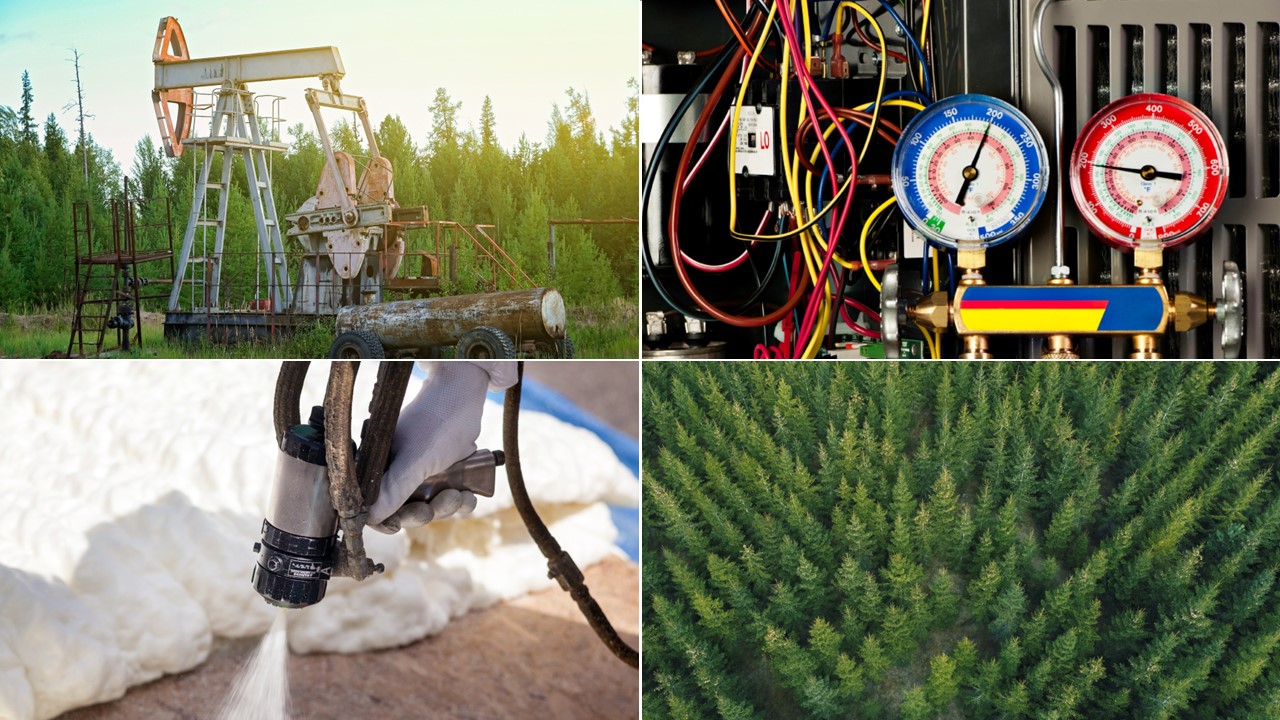

Destruction of Ozone Depleting Substances and High-GWP Foam 1.2

Destruction of Ozone Depleting Substances from International Sources 1.0

IN SCIENTIFIC PEER REVIEW

Plugging Abandoned & Orphaned Oil and Gas Wells 1.0

Destruction of Ozone Depleting Substances and High-GWP Foam 2.0

Avoiding Conversion of U.S. Forests 1.0

Carbon Capture and Storage 2.0

ACR IN THE NEWS IN 2022

Here’s how to incentivize cleaning up landfills — the culprit driving one-fifth of global warming [Opinion] MarketWatch, Mary Grady and Megesh Tiwari, 31 October Blue carbon will be the next frontier of carbon crediting GreenBiz, Jesse Klein, 9 November Air-conditioner use will jump 280% in the next decades. How can we keep cool without making climate change worse? [Opinion] MarketWatch, Mary Grady, 9 August Little Rock nonprofit aims to standardize climate benefits for farmers Axios, Worth Sparkman, 19 September Carbon offsets have serious issues. Is it even possible to fix them? Fast Company, Adele Peters, 24 August Are carbon offsets a joke? A response to comedian John Oliver GreenBiz, Jim Giles and Jesse Klein, 30 August ACR emphasises additionality safeguards, carbon removals accounting in updated IFM methodology Carbon Pulse, Matt Lithgow, 13 July ACR to distinguish improved forest management projects that generate “removal” credits Carbon Pulse, Katherine Monahan, 18 April Operators May Earn and Sell Carbon Credits for the P&A of Inactive, Shut-in, or Temporarily Abandoned Wells JD Supra, Court VanTassell and Juliane Mahoney, 21 June State lands open for carbon crediting, but how good are those credits?GreenBiz, Jesse Klein, 2 MayAs disputes around logging increase, First Nations eye carbon credits as a way to generate revenue Globe and Mail, Jeffrey Jones, 19 January RESOURCES In 2022, ACR developed a series of blogs and primers to introduce some of the key challenges and opportunities in the realm of climate action that our methodologies are designed to address. In each primer, we introduce the challenge or the opportunity and explain how carbon market incentives can help unlock the solution. Carbon Capture and Storage Primer Foam Blowing Agents PrimerMethane Emissions from Landfills Primer

Ozone Depleting Substances Primer ACR Improved Forest Management (IFM): A Primer ACR Carbon Markets 101: Additionality and Baselines for Improved Forest Management Projects ACR Carbon Markets 101: High GWP Pollutants